Jun

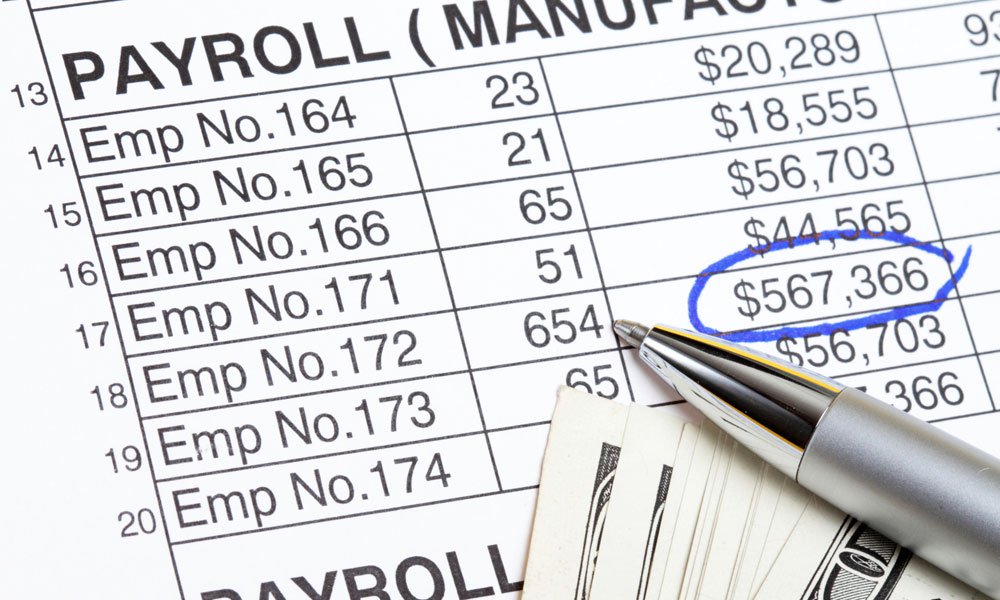

IRS Puts a 100% Penalty for Company Taxes

For anyone with employees, paying employment taxes is inevitable. The taxes are withheld from wages and are supposed to be promptly paid to the government. This is trust fund money that belongs to the government. You never want to become delinquent in paying taxes, especially employment taxes.

The IRS will encourage use of a payroll service. If the payroll service automatically takes out and remits all the payroll taxes, the business won’t have the discretion to divert the money, even briefly. When a tax shortfall occurs, the IRS will usually make personal assessments against all responsible persons who have ownership in or signature authority over the company and its payables. The IRS can assess a Trust Fund Recovery Assessment, also known as a 100-percent penalty, against every “responsible person.” If you are a responsible person, the IRS can pursue you personally for payroll taxes if the company fails to pay. The 100% penalty equals the taxes not collected.

The IRS can move to collect, but before a levy can be issued the IRS must provide notice and an opportunity for an administrative Collection Due Process hearing. This allows you the opportunity to ask for an installment agreement. There are special rules in the case of a predecessor employer. That is, this procedural safeguard won’t apply if you are a predecessor employer. Here’s what the IRS evaluates to determine if one business is a predecessor of another:

- Does it have substantially the same owners and officers?

- Are the same individuals actively involved in running the business, regardless of whether they are officially listed as the owners/shareholders/officers?

- If the taxpayer’s owners or shareholders are different, is there evidence they acquired the business in an arm’s-length transaction for fair market value?

- Does the business provide substantially the same products, services, or functions as the prior business?

- Does the business have substantially the same customers as the prior business?

- Does the business have substantially the same assets as the prior business?

- Does the business have the same location/telephone number/fax number, etc. as the prior business?

A business won’t be treated as a predecessor if there was a genuine change in control and ownership. There’s no right to a Collection Due Process hearing to resolve the employment tax liabilities if you already had your chance.